Becca Gomez supports ROG+ Partners with business valuation analysis and M&A services. She examines financial statements, conducts economic research, develops valuation models, and prepares written reports. Before joining ROG+ Partners, Becca held previous positions at Stanley Ventures as a Venture Capital Analyst Intern and at PTC as a Corporate Development Intern. Becca graduated from Tufts University in May of 2023 with a B.S. in Quantitative Economics and a minor in Entrepreneurship.

Navigating Regulatory Uncertainty: DBE/MBE Program Changes and A/E Firm Strategy

June 18, 2025

Recent legal challenges have placed Disadvantaged Business Enterprise (DBE) and Minority-owned Business Enterprise (MBE) programs under intense scrutiny. On May 28, the U.S. Department of Transportation filed a motion in the Mid-America Milling Company v. DOT case asking a judge to block race- and sex-based presumptions in its DBE program—a move that has made the future of set-aside contracting suddenly uncertain. While the legal process unfolds, owners and executives across the architecture and engineering (A/E) industry are evaluating how potential policy shifts could impact business growth and long-term firm value.

To gain perspective, we spoke with two industry leaders who have built successful firms with the help of DBE/MBE certification. These contrasting approaches—successful graduation versus continued participation—illustrate the varied ways A/E firms have integrated DBE/MBE programs into their growth strategies. Their experiences offer valuable insights into both the opportunities these programs have provided and the strategic questions that firms now face.

Lessons from Firms That Leveraged Certification Programs

For many small and emerging A/E firms, DBE/MBE certification has served as a crucial entry point to accessing public-sector contracts and building lasting client relationships. This was the experience of Jennifer Toole, Founder & President of Toole Design Group, a multi-modal transportation planning and design firm. Toole Design Group began as a WBE-certified firm, leveraging its status strategically to establish the revenue foundation and client base necessary for its rapid organic growth.

"Our certification helped us grow and become a strong company, to the point where we graduated from the program and didn't need it anymore. We've doubled in size since our graduation in 2018," Toole explains.

While Toole Design Group has successfully graduated from DBE/MBE programs, Rodriguez Consulting, a Pennsylvania-based civil engineering and land surveying firm, remains actively certified and continues to benefit from these programs. The firm’s President/CEO, Lou Rodriguez, reflects on the ongoing value: "The programs provided us with initial access to contracting opportunities that otherwise may have been out of reach."

In both cases, certification delivered benefits beyond individual contracts—opening doors to teaming relationships and providing the revenue foundation necessary for long-term strategic positioning.

Despite the high-profile legal developments, both leaders report surprisingly little immediate disruption at the operational level. Many public agencies have remained relatively quiet in response to the federal developments, with minimal formal guidance or shifts in procurement processes. This suggests agencies may be waiting for clearer guidance and/or legal rulings before making significant changes.

However, for firm owners, this period of regulatory uncertainty creates strategic planning challenges that extend well beyond the immediate legal outcomes.

Market Dynamics and Valuation Implications

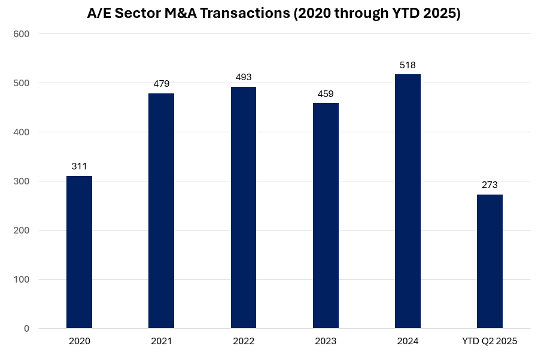

The regulatory uncertainty surrounding DBE/MBE programs occurs within a broader context of industry transformation. Market analysis by Rusk O'Brien Gido + Partners, which maintains a comprehensive industry transaction database, shows merger and acquisition activity in the A/E sector reached a record 518 transactions in 2024. As of Q2 2025, the sector has already seen 273 deals—putting the industry on pace to exceed last year’s total.

Version 2 (added a graphic for some pizzazz):

The regulatory uncertainty surrounding DBE/MBE programs occurs within a broader context of industry transformation. Merger and acquisition activity has accelerated significantly in recent years, as illustrated below.

Merger and acquisition activity in the A/E sector reached a record 518 transactions in 2024. As of Q2 2025, the sector has already seen 273 deals—putting the industry on pace to exceed last year’s total.

This consolidation trend intersects with DBE/MBE program uncertainty in ways that could reshape competitive dynamics. While larger firms can leverage scale advantages and diversified revenue streams to navigate regulatory changes, smaller firms may find their strategic options more limited if these programs are modified or eliminated.

For firm owners preparing for ownership transitions—whether through internal stock transactions, ESOP formations, or third-party transactions—the following characteristics may become more important valuation considerations:

- The percentage of revenue tied to set-aside programs

- Geographic concentration and exposure to changing state-level policies

- The firm's ability to compete effectively without certification advantages

Proactive owners should scenario-plan how future policy shifts could affect both near-term revenue visibility and long-term growth assumptions—two key drivers of firm value.

Administrative Issues Spark Reform Debate

The current legal and regulatory uncertainty has prompted stakeholders to consider various approaches to addressing DBE/MBE program challenges. Both Toole and Rodriguez identify administrative complexity as a significant concern. Rodriguez notes, "You can be certified in one state but need to go through completely different processes in neighboring states, even for similar types of work." This lack of standardization creates compliance costs for both participating firms and administering agencies. Additionally, graduation processes can create transition difficulties for firms caught between program eligibility and full market competitiveness.

Different stakeholders propose varying solutions—from fundamental restructuring to market-based alternatives. For firm owners, however, the primary concern is developing strategic plans that remain viable under multiple regulatory scenarios rather than predicting which approach policymakers will ultimately adopt.

Strategic Recommendations for Firm Leaders

While legal challenges continue, A/E firm leaders should remain focused on the business planning implications of potential changes. Regardless of regulatory outcomes, firms can take concrete steps to strengthen their strategic position:

- Monitor procurement evolution: Track how agencies adapt their language and participation goals. Pay attention to shifts in RFP requirements, goal-setting methodologies, and evaluation criteria that may signal broader policy changes. Establish a systematic approach to monitoring these changes across your key clients and geographic markets.

- Assess revenue concentration: Evaluate client mix and exposure to set-aside programs. Identify which projects were likely awarded due to certification status and quantify this revenue stream as a percentage of total annual revenue. Map this exposure across different client types (federal agencies, state agencies, municipal governments) and project categories to understand geographic and sector-specific risks. For high-concentration firms, identify alternative revenue sources and develop specific strategies to replace certification-dependent work with capability-based opportunities.

- Strengthen core value propositions: Emphasize technical expertise, client relationships, and community impact beyond certification status. The objective is to reduce dependency on certification by becoming a trusted and valued service provider and teaming partner. Develop multiple pathways for agencies and prime contractors to recognize your firm's value.

- Adjust plans for ownership transitions: Consider how certification dependency impacts your firm’s value and ownership transition strategy. Assess how your firm’s value might be affected under different scenarios, such as loss of certification due to growth and graduation, internal ownership transitions that impact certification eligibility, or external sales to non-certified buyers. Develop strategies to mitigate value impairment under each transition scenario.

Conclusion

While courts and policymakers debate the future of DBE/MBE programs, A/E firm owners face immediate strategic planning decisions. The regulatory uncertainty requires scenario-based planning that addresses multiple potential outcomes rather than betting on any single resolution.

The firms that navigate this transition most successfully will likely be those that strengthen their competitive positioning across multiple dimensions: technical capabilities, client relationships, operational efficiency, and market diversification. Whether DBE/MBE programs continue in their current form, undergo substantial reform, or face elimination, firms with robust fundamentals will be better positioned to adapt to changing market conditions.

For A/E firm owners, the key takeaway is strategic preparedness: building businesses that can thrive under various regulatory frameworks while maintaining the flexibility to capitalize on opportunities as market conditions evolve.

About the Author

rgomez@rog-partners.com

p: 617.274.8051

m: 562.391.8521