Michael S. O'Brien is a principal in the Washington, DC office of Rusk O'Brien Gido + Partners. He specializes in corporate financial advisory services including business valuation, fairness and solvency opinions, mergers and acquisitions, internal ownership transition consulting, ESOPs, and strategic planning. Michael has consulted hundreds of architecture, engineering, environmental and construction companies across the U.S. and abroad.

The Pandemic’s Impact on A/E Firm Ownership

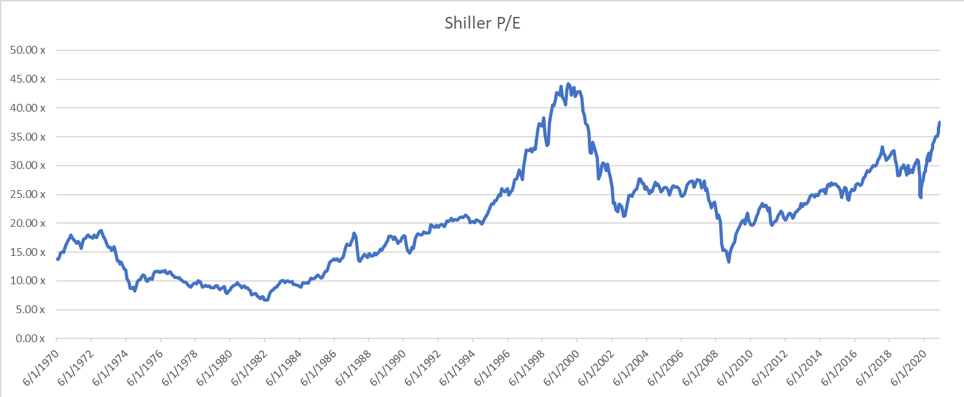

Earnings are expected to grow significantly in 2021; however, valuations are unlikely to continue their current growth rates of 14% per annum since 2010 and 17% per annum since 2016, as these levels are simply unsustainable. Valuation growth will likely flatten by the end of this year, and P/E multiples should begin to normalize over the next twelve to twenty-four months.

Other factors such as inflation risks and the prospect of higher taxes (income and capital gains) could also put downward pressure on stock values. We can look to history as a guide as to how such factors impact stock valuations. As the chart above shows, in the late 1970s and early 1980s, the U.S. was experiencing high inflation (the prime lending rate hit 21.5% in December of 1979) and high taxes, and P/E ratios were in the single digits.

In terms of ownership transition planning, the prospect of higher corporate income taxes is likely to cause firms to consider alternative ownership structures that include an employee stock ownership plan (ESOP) or an equity-based deferred compensation plan, which improve the liquidity of your shares and lower corporate tax and pass-through tax obligations. Furthermore, the potential for a substantial increase in capital gains tax rates puts pressure on owners considering a firm sale to consummate a transaction before rates increase.

If your time for retirement is fast approaching and you have the means to fund your retirement, now may be the time to take action. Whether you intend to sell your shares to your employees or sell your company to a strategic buyer, waiting too long could result in leaving substantial money on the table.

Michael O’Brien is one of 16 speakers scheduled to present at the Growth & Ownership Strategies Conference on November 3-5 in Naples, Florida. With over two decades of advising A/E firms - Michael will guide you in the steps needed to create a successful ownership transition plan in his breakout session titled Setting Up Your Ownership Plan.